How is a company treated in accounting when it pays advertising expenses? This article introduces advertising expenses because knowing how this works makes all the difference.

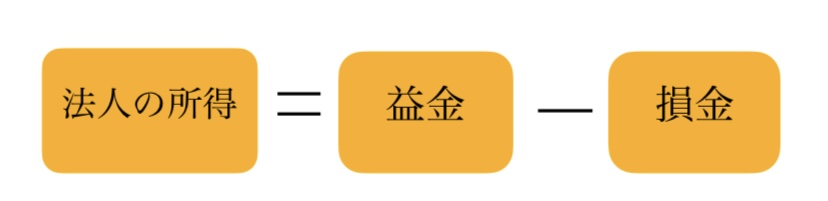

The corporate tax structure is really quite simple

Article 22(1) of the Corporation Tax Act provides that "The amount of income of a domestic corporation for each business year shall be the amount of its gross income for the relevant business year less the amount of its losses for the relevant business year.

For example, suppose that a company purchases a Shine Muscat for 1,000 yen and sells it for 1,400 yen.

Since the Corporate Tax Law stipulates that the amount of profit shall be the amount of proceeds from the sale of assets (Article 22, Paragraph 2 of the Corporate Tax Law), the amount of ¥1,400 is included in the amount of profit.

In addition, the Corporate Tax Law stipulates cost of sales as an amount that should be included in the amount of deductible expenses, so ¥1,000 is included in the amount of deductible expenses (Article 22, Paragraph 3 of the Corporate Tax Law).

Therefore, in the above example, 1,400 yen - 1,000 yen = 400 yen. If the corporate tax rate is 15%, the amount of corporate income is 400 x 0.15 = 60 yen, from which tax credits, if any, are deducted, and the remaining amount is the amount of tax to be paid.

Now, let's say you spent $100 as an advertising expense.

In this case, applying the previous calculation, 1400 yen - 1000 yen - 100 yen = 300 yen.

300 x 0.15 = 45 yen.

If no advertising expenses are used, corporate income is ¥400. The amount of tax paid is 60 yen.

If advertising expenses are used, corporate income is 300 yen. The amount of tax paid is 40 yen.

Now, if no advertising expenses are used, the company is free to spend ¥340. In contrast, if advertising expenses are used, the company is free to spend 260 yen.

Here, please notice that since the company is paying 100 yen for advertising, it is natural that there should be a difference of 100 yen with respect to the money the company can freely spend. However, the difference in the amount of money the company can freely spend is 80 yen.

In other words, if you pay advertising expenses, your tax payment will be 20 yen lower, and the difference between the tax payment and no advertising expenses will be reduced to 80 yen.

Then the idea is that if you pay 20 yen in taxes, it would be more beneficial to pay 20 yen in advertising expenses.

This is why companies pay for advertising.